Bildnachweis: Praewphan – stock.adobe.com, Bioscience Valuation BSV GmbH.

In March 2024, we reported a gradual increase of new drug approvals over the past 30 years, combined with an increasing focus on cancer, immunological and rare diseases, and a shift towards more complex product categories such as biologic and cell therapies. In this article, we investigate the current R&D pipeline and the resulting expected launch of innovative pharmaceuticals in the coming years.

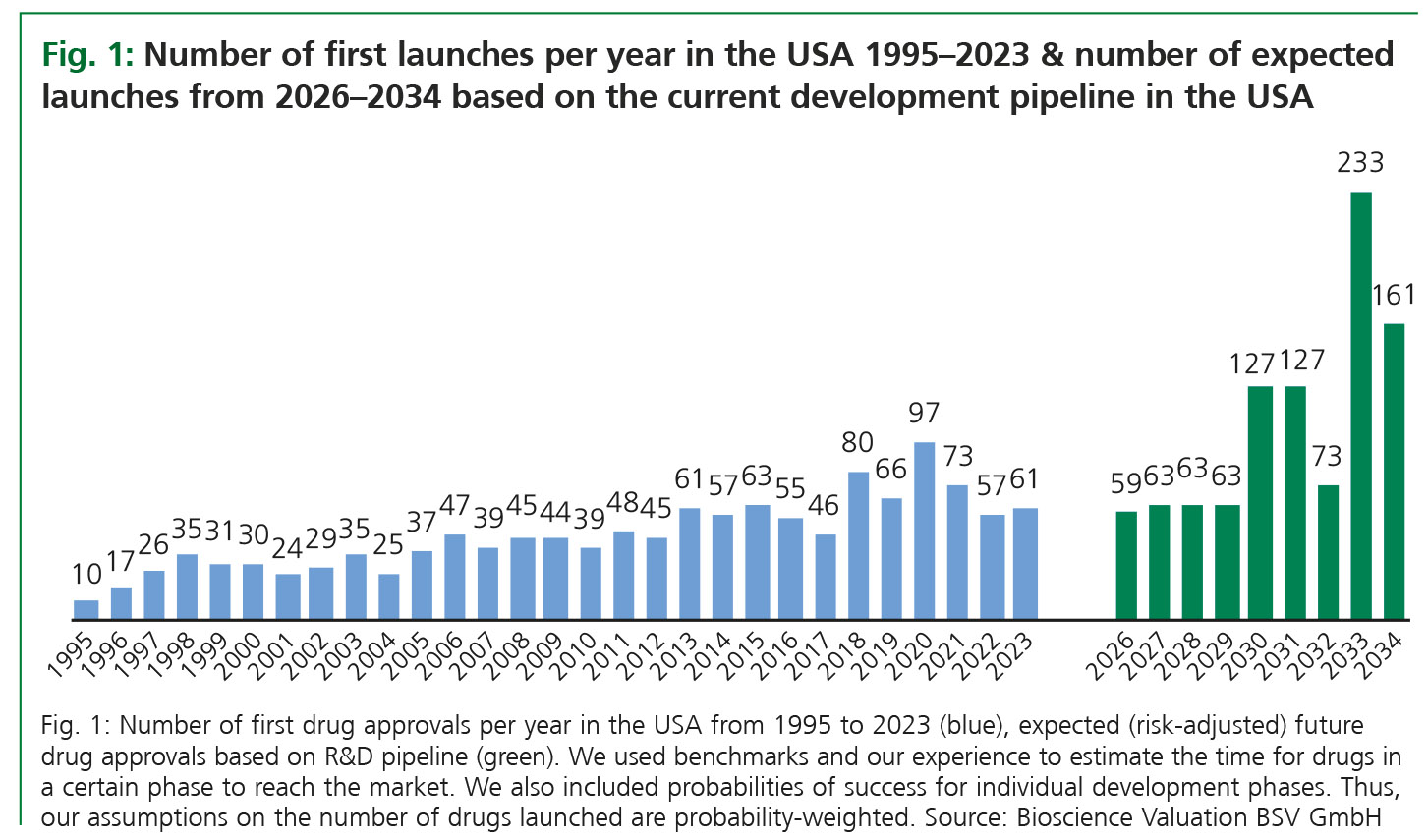

In the past 30 years, the R&D output has increased at a CAGR of 6.7% in the USA, with a significant yearly volatility. Based on products currently in development, we analysed the expected number of yearly new product launches in the coming ten years. Again, our analysis refers to the USA due to the availability of data in this territory.

Our dataset has been exported from the Pharmaprojects online database (August 2024). We focused our search on drugs that are currently in phase II, phase III or pre-registration because the information on the therapeutic indication appears more reliable compared to earlier R&D phases. We only included drugs that have not been launched in other markets of the world before. Furthermore, we focused on innovative products; therefore, reformulations were also excluded. We categorized the exported data according to the following criteria:

- drug type, including biologicals, cell therapies, small molecules, or combination therapies (the latter is a new category in the database including antibody-drug conjugates and other combinations, most of them including biologic components);

- therapy areas (e.g., rare diseases, oncology, neurology …);

- development phases (phase II, phase III, pre-registration).

In order to forecast how many drugs are expected to reach the U.S. market during the next ten years, we expanded our original list to also include drugs in phase I and preclinical development.

New product launches may double in the next decade

Available data suggest that in the coming ten years, the number of new drug launches will likely increase at a CAGR of 13% compared to 6.7% in the past 30 years. A particularly steep increase can be expected from 2030 on-wards, with potentially more than 200 new approved and launched drugs around the year 2033 (Fig. 1). Again, the yearly volatility will be high. Based on the expected growth of approvals, the overall number of marketed drugs in the USA may further increase from approximately 2,849 in 2024 to 3,817 in the year 2034.

Product categories will further shift towards biologics and cell therapies

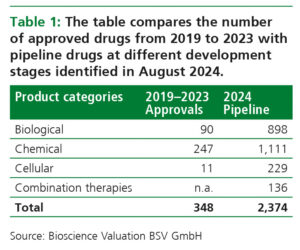

From 2019 to 2023, 71% of newly launched drugs were chemicals, 26% were biologics, and 3% were cell therapies. Based on the current pipeline analysed as described above, the relative proportions will significantly change in the time frame up to 2034 (Fig. 2). Only 47% of newly launched products in the coming ten years are expected to be chemicals; 38% will be biologics, and the number of cell therapies will increase to about 10%. Another 6% will be combination products (i.e., complex products that combine biologics with chemicals or other components).

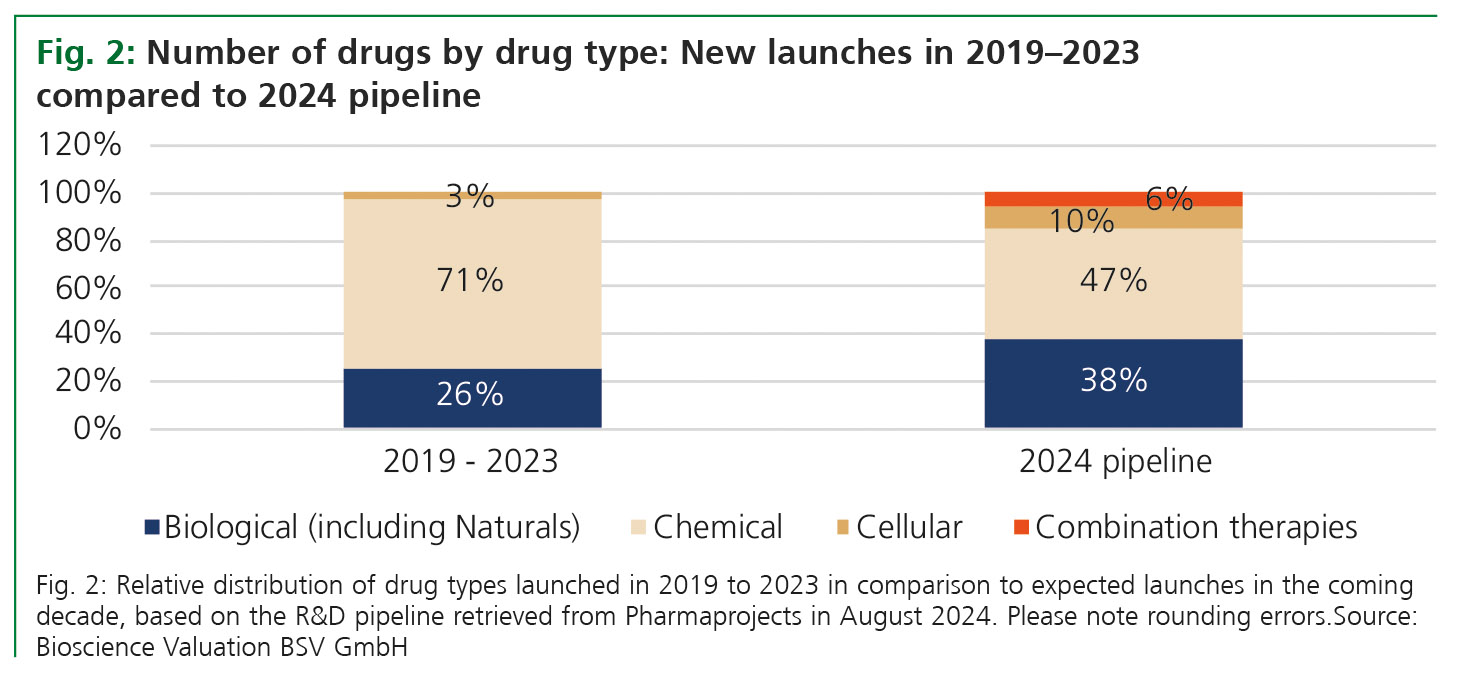

The technological progress generated by biopharma companies has resulted in a shift of development candidates towards biologics and cell therapies that can already be observed in the pipeline today (Table 1). Although attrition will reduce the number of pipeline drugs that finally reach the market, the table suggests that R&D output may grow significantly.

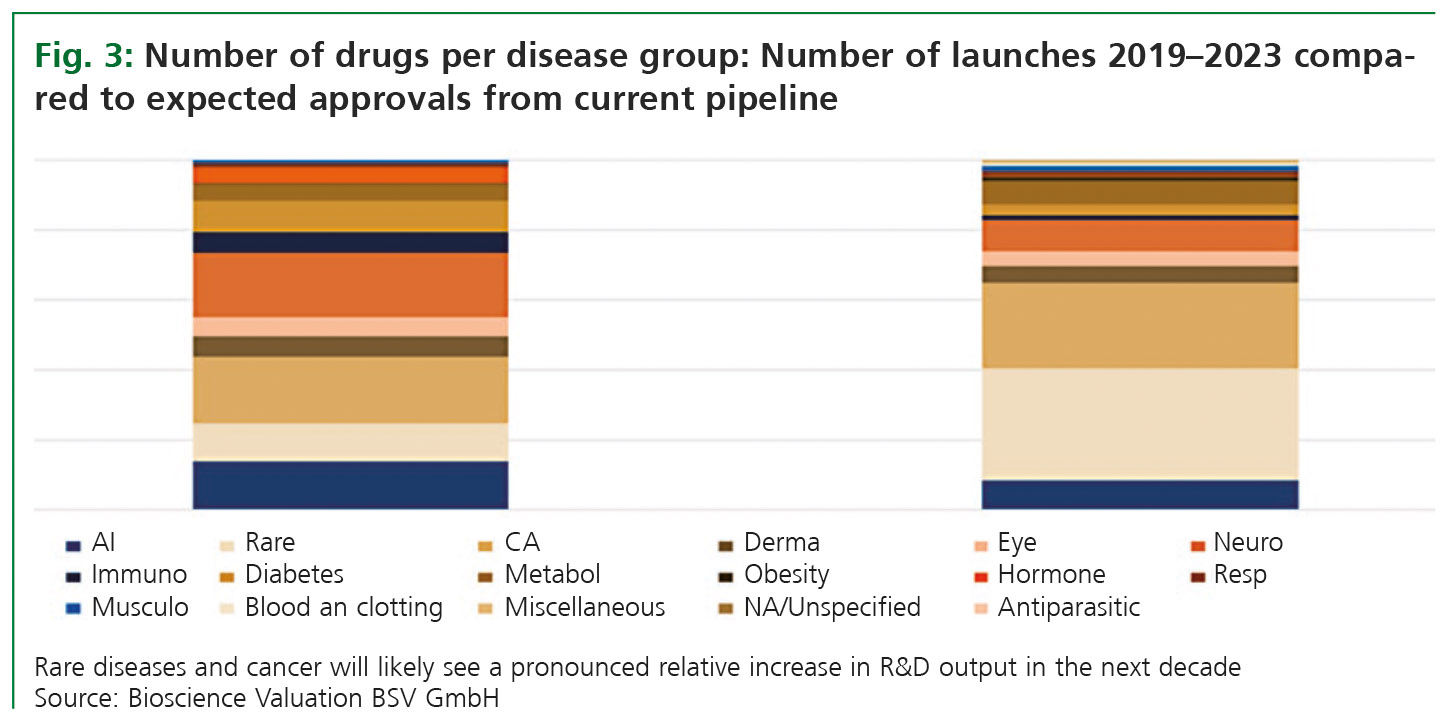

Relative number of disease groups suggests a strong shift to rare indications

Fig. 3 suggests that in the coming ten years, rare diseases will stand out with regards to new product launches. This category does not only include rare genetic diseases but also tiny subgroups of other diseases such as cancer. The R&D output for rare indications is expected to triple compared to others. While in the years 2019 to 2023, 11% of new product launches were addressing rare diseases, 32% can be expected out of the cur-rent R&D pipeline. In the same period, the number of approved cancer products will likely grow as well, from 19% to 24% of all expected approvals. Overall, the fraction of expected new products for rare diseases and cancer will grow from 30% in the past five years to 56% in the coming ten years.

Another disease category indicating growth is metabolic diseases with a relative increase in product launches from 5% to 7% of all product categories. Metabolic diseases also include obesity and diabetes. What appears to be a small increase in relative terms reflects a number of 17 new products launched from 2019 until 2023, while 162 new products are expected within the coming ten years, indicating that this is another focus area of the biopharma industry.

For all other disease categories, the relative contribution of future new product launches is expected to stay stable or to decline. This also applies to neurology, which is certainly an area of high unmet medical need. The expected relative number of new product launches in neurology will decline to 9% compared to 18% in the past four years, but this still reflects a number of 218 new products emerging in the coming ten years.

Conclusions

Three key messages can be derived from this analysis:

- While in the past 30 years, the R&D output in terms of FDA approvals grew at a CAGR of 6.7%, a growth of 13% can be expected in the coming decade.

- While 29% of new drugs launched in the USA in the years 2019 to 2023 were biologics or cell therapies, we expect a proportional growth of these categories to 53% in the coming decade. This will also include combination products of similarly complex nature.

- In the past five years, 11% of approved drugs in the USA targeted rare diseases, and 19% targeted cancer. These two drug categories will likely grow to proportions of 32% and 24% in the next decade, respectively, indicating that rare indications are a major focus of attention for biopharma.

These messages suggest that the overall healthcare cost for pharmaceuticals will likely increase exponentially in the next decade. Drugs for the therapy of cancer are often biologics and nowadays also cell therapies, which require complex and expensive production processes, making it difficult to keep production costs at moderate levels. A high price is commonly accepted for rare diseases because they would otherwise not be attractive targets for biopharma. Since rare diseases are numerous, they will also significantly drive healthcare cost in the next decade. It remains to be seen which measures will be taken to manage this cost increase.