Bildnachweis: beeboys – stock.adobe.com.

One dominant hypothesis in finance is the ‘Efficient Market Hypothesis’ (EMH), which states that the stock price of a security reflects all publicly available information at any given moment. Therefore, an investor will not be able to outperform an efficient market as stock prices are neither ‘under-’ nor ‘overvalued’1.

However, the EMH has been challenged, suggesting that comprehensive fundamental analysis may reveal anomalies in security pricing that would allow sophisticated investors to gain superior returns2.

You can find this article in the Life Science issue „Biotechnology“ – DOWNLOAD NOW FOR FREE!

In contrast to public markets, private markets have been considered less efficient due to factors such as, e.g., information asymmetry and illiquidity. Here we report that early-stage biotech investments create attractive opportunities to beat the market. It is generally believed that early-stage biotech investments offer lower returns compared to late-stage opportunities. However, returns need to be judged relative to the risk an investor assumes. We will argue later that the returns earned by early-stage investments are disproportionate to the risk assumed.

Risk vs. return

A fundamental relationship in finance is that high risk be accompanied by high return. However, we need to distinguish between ‘systematic’ and ‘unsystematic’ risk. For public markets, the Capital Asset Pricing Model describes systematic risk as the covariance of the stock with the market3; the systematic risk determines the cost of capital figure that has to be applied to discount future cash flows. Unsystematic risk is unique to the investment opportunity and is typically reflected in probabilistic adjustments of forecasted cash flows. Unsystematic risk can be significantly reduced (or, for public securities, almost nullified) through broad diversification. Finance also assumes that professional investors in private equity are well-diversified (thus, unsystematic risk does not determine discount rates). In biotech, key unsystematic risk is represented by the notoriously high attrition rates observed in clinical development.

Resolution of unsystematic risk is a key value driver in biotech

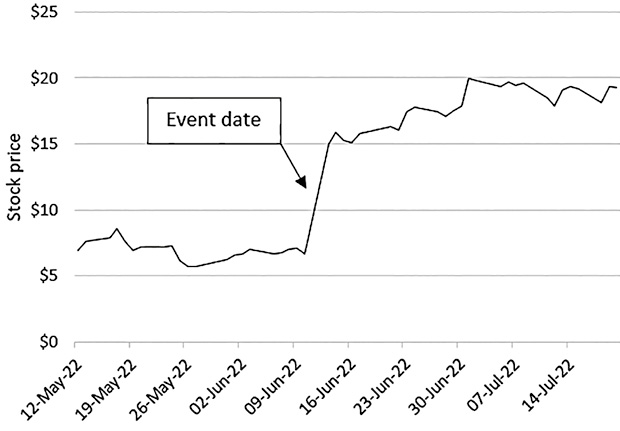

The value jumps of publicly listed small cap biotech companies upon successfully reaching a milestone are largely in line with the perceived risk of the development phase that has been concluded with favorable results. A recent example is the value increase of Day One Biopharmaceuticals (DAWN) when its drug DAY101 reached a Phase III milestone. On June 12, Day One Biopharmaceuticals announced that its drug DAY101 (tovorafenib) achieved positive initial data from the pivotal FIREFLY-1 trial in relapsed pediatric low-grade glioma patients. The data reports an overall response rate (ORR) of 64% and a clinical benefit rate (CBR) of 91% in the first 22 evaluable patients treated with tovorafenib monotherapy4. The announcement caused Day One Biopharmaceuticals’ stock price to increase by about 126% (same day performance; see Figure 1)5.

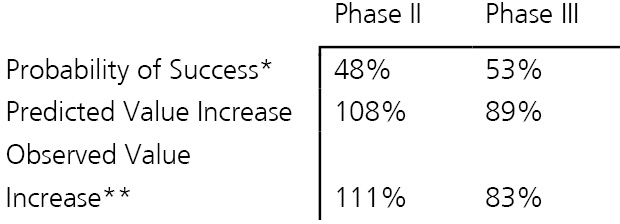

The observation that the price of a security jumps upon positive clinical study news can be generalized. Table 1 illustrates our findings looking at a small sample of figures.

The observed appreciation of company value is largely in line with the predicted value increase based on the study risk resolved6. One may thus argue that the market is efficient because both an asset’s value before and after an event (such as reaching a development milestone) correctly reflect the uncertainty concerning study outcome.

Misconceptions concerning early-stage biotech investing

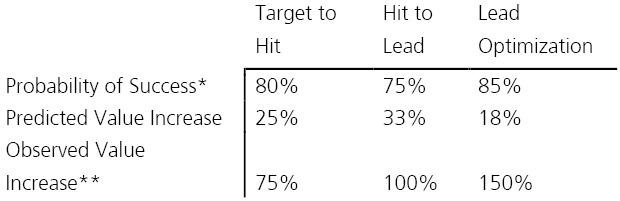

It is generally believed that the value of biotech companies can best be described as a discontinuous growth function with small value gains at early discovery and significant value jumps during clinical development. Therefore, there is considerable interest to invest in late-stage biotech assets, as value may increase manyfold after important events. In contrast, the value gain of assets in discovery or early preclinical research is considered minimal when compared to clinical development. Table 2 describes predicted and observed value gains in early-stage biotech companies depending on the discovery phase.

In relation to phase II and phase III clinical development, the expected increase in value upon reaching a preclinical milestone is smaller indeed. However, comparing predicted with observed value gain reveals a striking difference. While observed clinical value gains are roughly equivalent to predicted values, observed value gains in discovery, though at a smaller scale, are significantly higher than predicted considering stage-specific attrition rates.

Taking advantage of market inefficiencies

As outlined above, value gains in clinical development are, at least in part, explained by resolving unsystematic risk upon reaching a milestone, while value gains in discovery research are higher than predicted by the resolution of stage-specific risk. Therefore, an investor may benefit from superior returns relative to the risk assumed. It should be noted that the assessment is based on validated targets; innovative targets may require additional validation studies that have their own risks. However, the required investment for those studies is typically an order of magnitude lower than the funds required to conduct clinical studies. Thus, in our opinion, defining an investment strategy based on early-stage investments may lead to a relative outperformance considering an investment’s Sharpe Ratio7.

Opportunity to diversify development risk

A key advantage of investing in early-stage biotech projects is the possibility to diversify risk for funds with limited resources. As costs for a clinical development program of a single asset can easily exceed EUR 50 million, an investor able to spend that amount on a single investment opportunity may as well invest it in a diversified portfolio of preclinical assets. Although venture capital funds tend to syndicate investments to diversify risk, investing in early-stage opportunities may allow for an even broader diversification, thus shielding a fund’s exposure to unsystematic risk and allowing to maximize its Sharpe Ratio (i.e. maximize its financial return proportional to the risk taken).

Implications for investors

Investors are constantly seeking superior investment opportunities by exploiting information asymmetries. We suggest that investing in early-stage biotech opportunities may lead to financial outperformance relative to the assumed risk. This is in contrast to the current perception that deems early-stage opportunities as less attractive. Obviously, the conclusion is only valid in the event assets can be licensed or sold at favorable terms during or at the end of preclinical development. Research at Bioscience Valuation indicates that this in indeed happening. When certain conditions regarding the degree of innovation are met, preclinical licensing or asset deals may offer unprecedented returns exceeding expectations.

In summary, we propose that investors take a closer look at early-stage biotech investment opportunities, analyze them well, and take advantage of apparent market inefficiencies. One should keep in mind that not only investors can benefit from an early-stage investment opportunity: Society as a whole stands to benefit, as the support of early, translational research may lead to new, innovative treatments of severe diseases in the long run.

1) A popular read supporting the efficient market hypothesis is by Burton G. Malkiel, ‘A Random Walk Down Wall Street’, W. W. Norton & Company, 2019.

2) A well-known book suggesting deviations from the EMH is by A. W. Lo and A. C. MacKinlay, ‘A Non-Random Walk Down Wall Street’, Princeton University Press, 1999.

3) Sharpe, W. F. (1964): Capital asset prices: A theory of market equilibrium under conditions of risk. In: The Journal of Finance, 19(3), pages 425–442.

4) Day One Biopharmaceuticals Press Releases: https://ir.dayonebio.com/news-releases/news-release-details/day-one-announces-positive-initial-data-pivotal-firefly-1-trial (retrieved September 2022)

5) PitchBook online database (retrieved September 2022)

6) Although small in this sample, some deviation from predicted value to observed value is expected due to the fact that a typical biotech company manages a portfolio of assets. Hence, share price is not solely determined by a single project that has reached a significant development milestone.

7) The Sharpe Ratio measures the performance of an asset relative to the assumed risk; it is often perceived as a better benchmark for a fund’s success than absolute return.