It is generally believed that, as projects advance in discovery research, little value is created because the products are still years away from the market and subject to considerable technical risk. Therefore, many venture capital (VC) investors shy away from investing in biotech companies, and those who do invest in biotech often prefer more mature companies beyond the discovery stage. By Philipp S. Steinbach, Selina K. Greuel and Merlin M. Greuel

Almost all studies that investigate the impact of reaching development milestones on stock market returns focus on publicly listed biotech companies, as value jumps after successful clinical trials can easily be observed from stock price movements at the date of trial result announcements.[1], [2] Less is known how privately held biotech companies appreciate in value once critical milestones have been reached.

Taking advantage of datasets available at Bioscience Valuation, we compare investment in late-stage projects vs. investment in early-stage projects in terms of expected and obtained returns. As outlined in an earlier publication, we will argue that investments in early-stage projects represent a promising strategy, especially for smaller funds. We define ‘early’ projects as those being in discovery (milestones: target to hit, hit to lead, lead optimization) or preclinical research, and ‘late’ projects as those being in clinical development (phase I, phase II, phase III).

Expected value jumps in clinical development

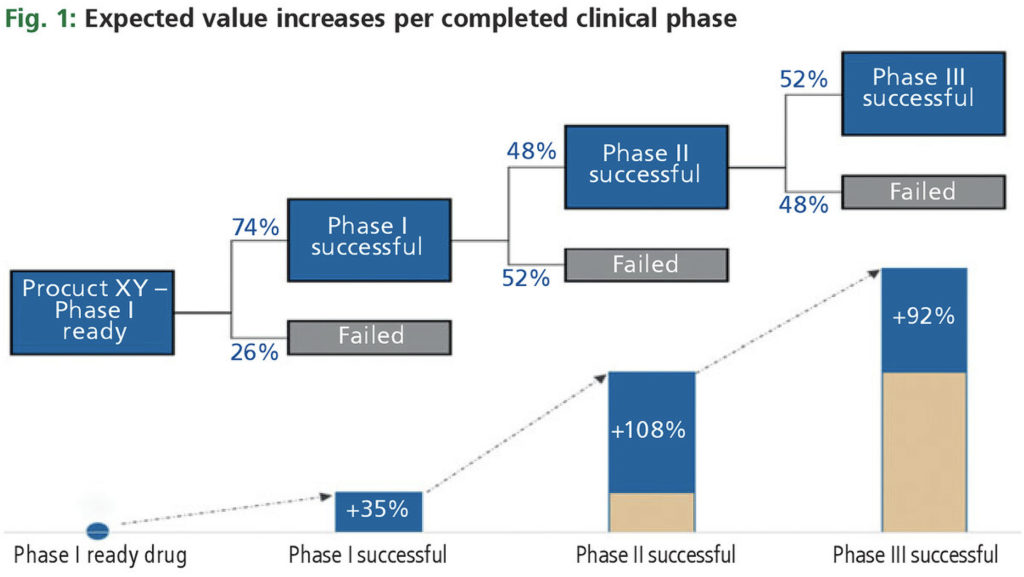

As described elsewhere, the resolution of technical risk is a key value driver in biotech.[3] Fig. 1 shows the expected value jumps in clinical development. In theory, the result of a clinical study is a binary outcome; the study is either successful or unsuccessful. The expected increase in value is proportional to the development risk resolved. Applying general attrition rates (not specific for a particular indication or group of indications), one may expect a value jump of 35% after successful phase I, 108% after successful phase II, and 92% after successful phase III.

Observed value jumps in clinical development

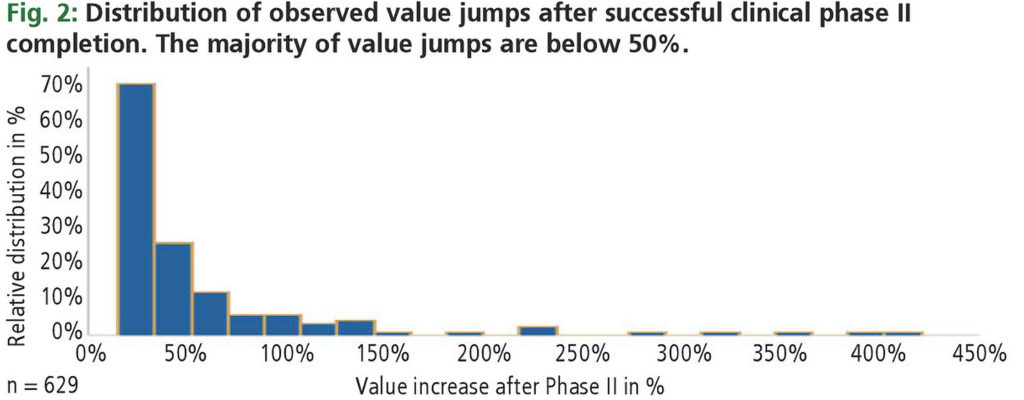

While significant value jumps may be expected once development risk has been resolved, the observed gain in value is generally less than predicted. Fig. 2 shows that, for a large sample of phase II events in publicly listed biotech companies, the vast majority of value gains are below 50%. Reasons include:

- a large portfolio mitigating the impact of a single event

- lower than expected efficacy,

- safety issues, and

- low sales potential.

Therefore, except for portfolio effects, financial returns may be not as encouraging as often believed. We will argue later that, even when applying expected (and not observed) return benchmarks, early-stage investments will consistently outperform late-stage investments in Monte Carlo portfolio simulations.

Expected value jumps in discovery research

Unlike clinical research, benchmarks indicate high success rates in discovery research.

Therefore, the expected value increases in discovery research are lower than for the clinical phases and range from 18% to 33%, depending on the stage. The maximum expected value gain equals 96% from ‘target identified’ and validated to ‘lead optimization successful’. Due to both, the low scale of investment and comparatively low-value gains, many investors are loath to invest in early-stage companies, although a closer analysis of the economics tells a different story.

Value gains of early-stage companies

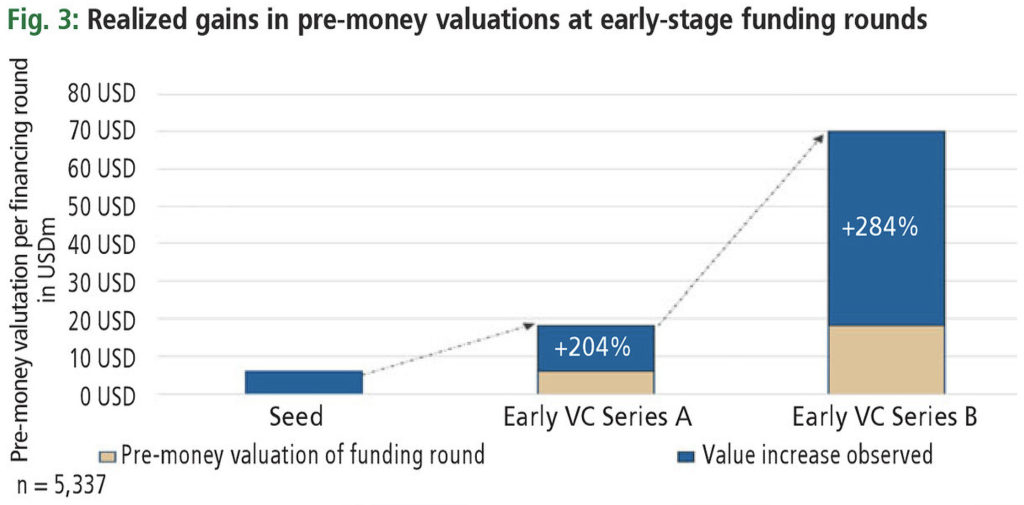

Unfortunately, increases in value once discovery milestones have been reached are not readily observable. As a substitute measure, one may analyze the increase in pre-money valuations of biotech companies in their early stages. Fig. 3 shows how pre-money valuations of biotech companies develop as a function of the investment round. Data have been sourced over the past ten years and include all geographies. Plotted are the median pre-money valuations of the respective funding round.

Applying benchmarks, series A funds typically take a biotech company to the end of preclinical development, with a pre-money valuation in the order of USD 70 million. Please note, there is a high variance in pre-money valuations, with some being significantly above and some below that benchmark. Nevertheless, the observed gains in pre-money valuations exceed the expected gains by an order of magnitude. Of course, other risks beyond technical ones exist, but most analysts may agree that the resolution of technical risks and reaching important milestones are key value drivers in discovery research. One may thus inquire whether an investment strategy focusing on early-stage investments may, on average, outperform strategies that prefer late-stage investments.

Early-stage vs. late-stage investment strategy

Based on benchmarks, a USD 150 million fund may either invest in a portfolio of ten early-stage opportunities (‘target identified’ to ‘end of preclinical research’) or in a portfolio of three clinical assets (’phase I’ to ‘end of phase III’). Again, applying typical attrition rates and value gains, we ran a Monte Carlo simulation with 10,000 iterations each for both strategies.

The Monte Carlo simulation suggests an overall portfolio return of 316% (annualized rate of return: 33%) for the ‘early-stage’ investment strategy and a lower 199% portfolio return (annualized rate of return: 20%) for the ‘late-stage’ investment strategy. At the same time, the portfolio standard deviation of return is less for the ‘early-stage’ strategy (179%) than for the ‘late-stage’ strategy (362%), leading to a return-to-risk ratio of 1.77 for the ‘early-stage’ investment strategy, compared to 0.55 for the ‘late-stage’ investment strategy. Thus, the ‘early-stage’ strategy offers a considerably higher return potential relative to the risk assumed than its ‘late-stage’ counterpart.

Implications for investors

Our results confirm an earlier analysis indicating that early-stage investments may outperform late-stage investments.[3] Preliminary analyses of fund returns at Bioscience Valuation suggest indeed that specialized funds that focus on early-stage biotech investment opportunities yield higher returns than funds that focus on late-stage opportunities. In summary, we find that

- for late (clinical) development, value jumps are lower than expected (leading to lower returns),

- for discovery (early development), value increases are higher than expected (leading to higher returns),

- investments in discovery (early development) have higher, more favorable return-to-risk ratios, and

- investments in discovery (early development) allow greater diversification of risk.

Especially smaller funds may profit from the prospect of diversifying broadly and produce high returns when investing in early-stage assets.

[1] T. J. Hwang (2013): Stock market returns and clinical trial results of investigational compounds: An event study analysis of large biopharmaceutical companies, PLOS ONE, Vol. 8, e71966.

[2] M. Singh et al. (2022): The reaction of sponsor stock prices to clinical trial outcomes: An event study analysis, https://doi.org/10.1371/journal.pone.0272851.

[3] M. M. Greuel et al. (2022): Exploiting market inefficiencies in early-stage biotech investing, Plattform Life Sciences 3, Biotechnologie 2022, 116-117, 2022.

ABOUT THE AUTHORS

Philipp S. Steinbach received his Bachelor in Finance from the Frankfurt School of Finance & Management, Germany, and his Master in Finance from the University of Innsbruck, Austria. He began his career as Financial and Business Analyst at Bioscience Valuation and is now Lead Financial Analysis as well as Engagement Manager at the company.

Selina K. Greuel studied medicine at the Charité University Hospital in Berlin and is currently pursuing her MBA studies at the University of Cambridge, UK. She works for Bioscience Valuation as Healthcare Consultant and Lead Scientific Analysis.

Merlin M. Greuel received his BA in Psychology from Stanford University, USA, his Master of Global Health from the University of Barcelona, Spain, and his MD from the University of Heidelberg, Germany. After beginning his career as Healthcare Analyst at Bioscience Valuation, he now works for the company as Lead Corporate Development.