Bildnachweis: Siarhei – stock.adobe.com.

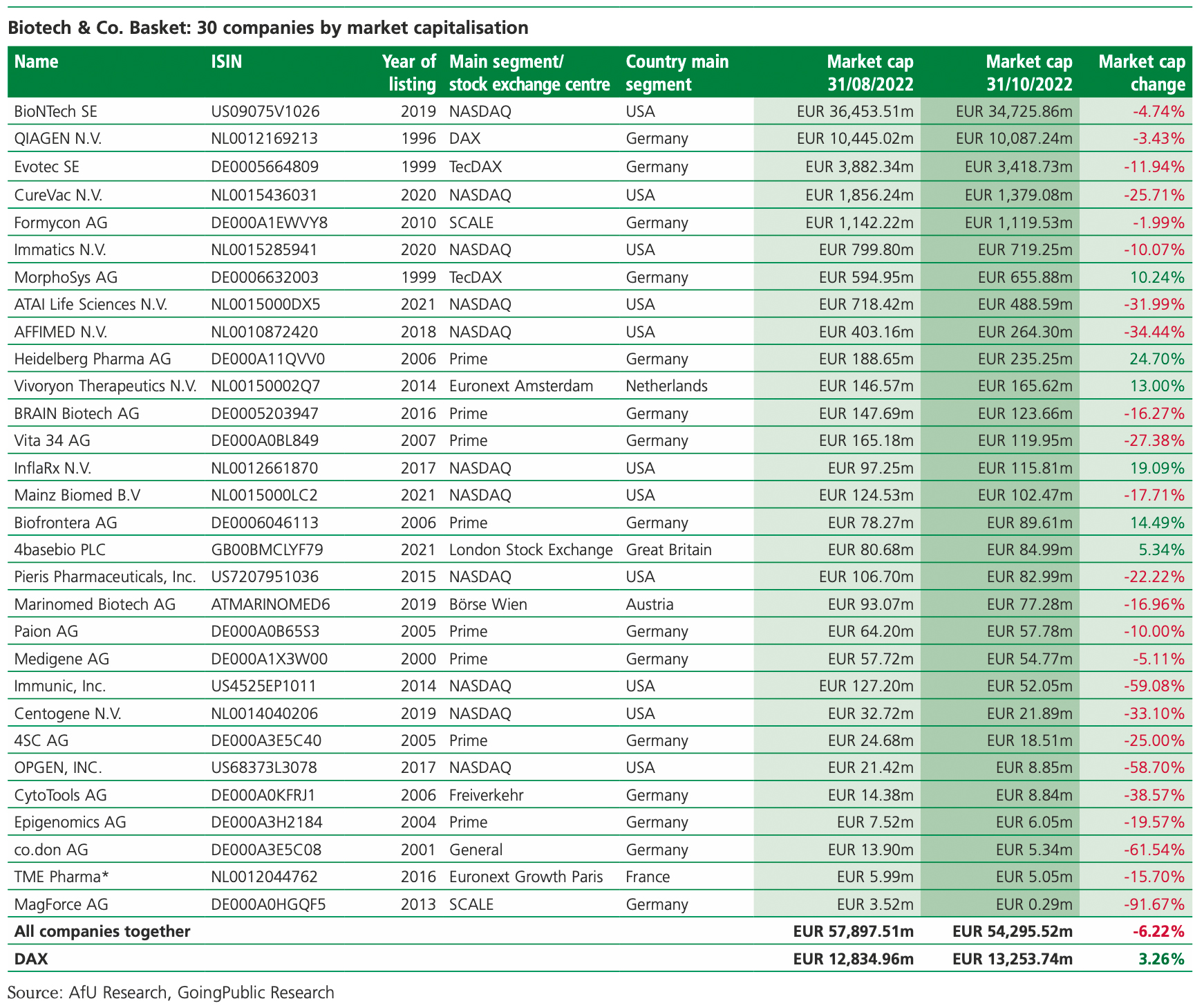

In May, Plattform Life Sciences created its Biotech & Co. basket that included 30 German companies listed in Germany and abroad and reported an initial cumulative market value of 54.9 billion euros as of the end of April. Austria is also represented by biotech company Marinomed, whose shares are traded in large volumes at German stock exchanges. The goal is for the diversity of listed German biotechnology companies to be reflected in the performance of their shares.

The most important figures and market price development values of the biotech basket at a glance (as of 31 October):

-

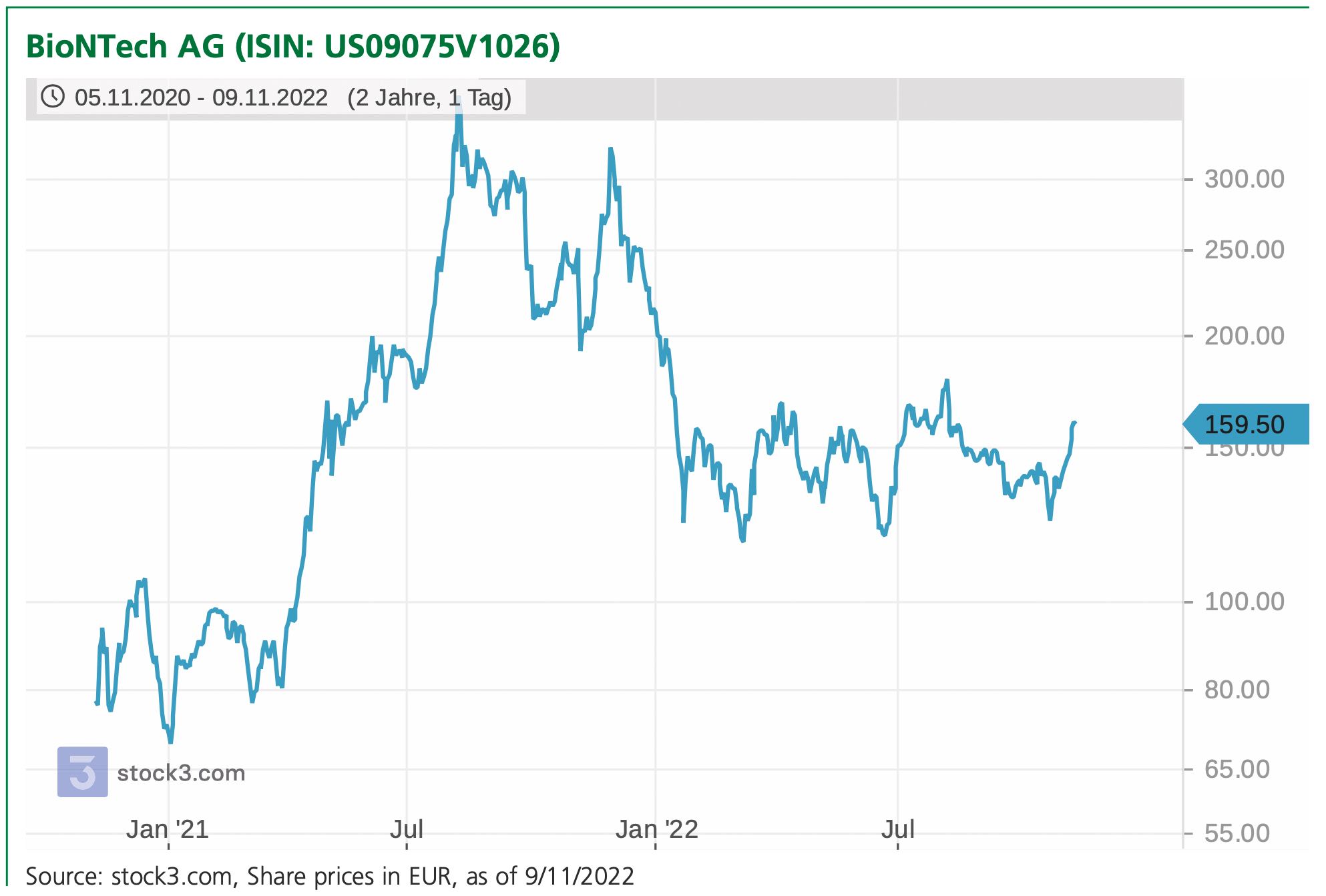

- As of the end of the reporting period, the market value came to almost 54.3 billion euros. Of that amount, 64 percent was attributable to BioNTech AG, which has been listed in the Nasdaq index since the end of 2019.

-

- The four largest companies (BioNTech, Qiagen, Evotec and CureVac) account for 91.4 percent of the entire market value in the amount of almost 54.3 billion euros.

- Formycon, Immatics, Heidelberg Pharma and Biofrontera are the only four companies in the basket that have recorded a positive price development since the beginning of the year. With a price increase of 71.5 percent, the undisputed leader is Formycon AG, a developer of biosimilars.

- Four companies (MorphoSys, Heidelberg Pharma, Vivoryon Therapeutics and 4basebio) also saw price gains in the reporting period from 31 August to 31 October. These were led by Heidelberg Pharma with an increase of 24.7 percent.

- In total, the companies contained in the basket have lost 35.4 percent of their market value since the end of 2021. In figures, that comes to 29.8 billion euros. 15 of the 30 companies in the basket have seen price losses of over 50 percent since the beginning of the year.

- Half of the 30 companies trade or are primarily listed abroad. Nasdaq is the undisputed leader with eleven listings, followed by Euronext with two and the London Stock Exchange with one.

The broad internationality is also reflected in the legal forms: 14 German stock corporations (Aktiengesellschaften or AGs) and two European “SE”s are joined by nine Dutch “N.V.”s, three US “Inc.”s, a “PLC” and a “BV”.

Capital measures and news drive prices

The sustained negative price development of the biotech basket reflects the current market trends. Therefore, as a globally important sector index, the Nasdaq Biotechnology Index has lost approximately 15 percent of its value since the beginning of the year. In addition to internal company developments, the sometimes significant share price losses, particularly in the case of smaller biotechs, are also due to the monetary policy environment. In view of increasing interest, the capital-intensive pipelines of sector analysts are valued lower due to the higher discount rates. At the same time, positive news continued to create positive price fluctuations.

For instance, Heidelberg Pharma secured gross issuing proceeds of 80 million euros at the end of August through a capital measure that saw Chinese partner Huadong Medicine become the company’s second-largest shareholder with an interest of 25 percent. The conclusion of a licensing deal with Japanese pharma company Takeda followed in September. Thanks to a private placement in the amount of 15 million euros with the option of a further 15 million euros within the upcoming twelve months, the share of Vivoryon Therapeutics saw capital gains of over 30 percent at the end of September.

For weeks, the share price of MorphoSys has been spurred on by the prospect of positive clinical study data from its partner Roche. The Swiss pharma company will present the phase III results for Gantenerumab, an Alzheimer antibody, at a symposium at the end of November. Should an approval follow, MorphoSys will receive a revenue share of three percent. Forty percent of that amount will go to the company’s coffer.

Insolvencies and name changes

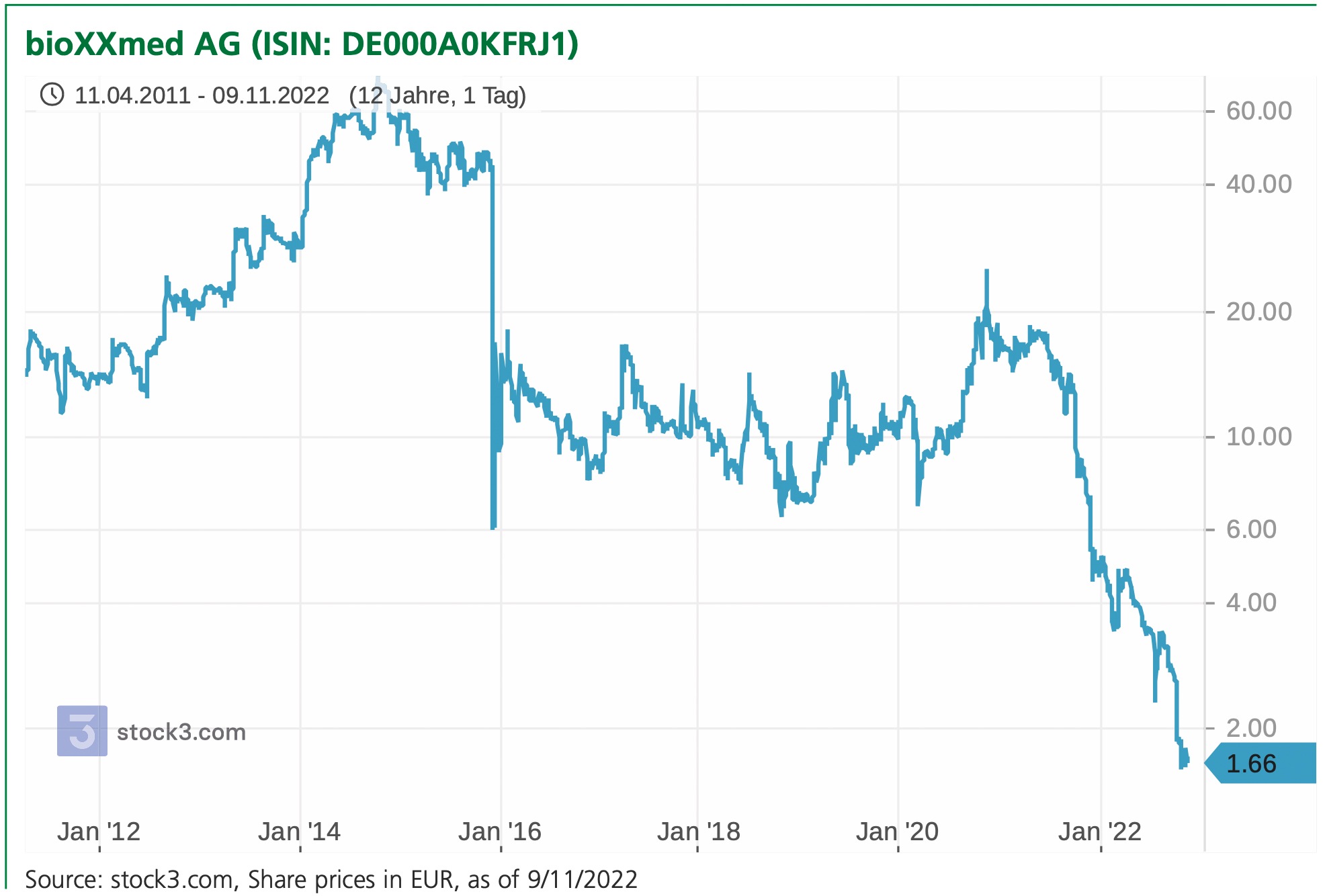

MagForce and co.don are two values which will no longer be included in the upcoming basket statistics due to ongoing insolvency procedures. MagForce retracted its listing, while co.don is facing the sale of its core business as part of its ongoing administration procedure. An agreement was met with Rejuvenate GmbH in October for the sale of its core business for 15 million euros. The proceeds will also satisfy the claims of the creditors. At its Annual General Meeting, Cytotools AG decided to change its name to bioXXmed AG. They have also repositioned their main product. Following the cancellation of the phase III clinical study, DermaPro will be further developed as a medical technology application.

Summary

The volatility of most titles has continued in parallel to the share price development of the last two months. The cumulated market value decreased by 3.6 billion euros, or 6.2 percent. An important role here was played by the exchange losses suffered by heavyweights such as CureVac and BioNTech. BioNTech’s dominance, which amounts to over 60 percent of the current market cap, will continue to influence the development of the basket’s share price development in the future. A further characteristic of the composition is that, in addition to the five titles with a market value of over 1 billion euros, only five companies currently have a market cap of 200 million euros – thus falling in a weight class that usually catches the attention of institutional investors.

Autor/Autorin

Stefan Riedel

Stefan Riedel ist freier Autor bei GoingPublic Media und selbständiger Redakteur mit Schwerpunkt Finanzen und Wirtschaft.