While financing of biotech companies in the US remains at record highs, investors continue to show little faith in the European market – despite various recent positive developments. In contrast, we do not regard the quality of European life sciences companies in general as inferior to their US counterparts. In this article we discuss potential reasons for this apparent misperception. More importantly, we describe several recent positive trends that justify a more positive outlook. By Dr Marcus Wieprecht

The life sciences industry is definitely an exciting one, as demonstrated by various medical break-through developments in the last two decades. Some examples are immuno-oncology therapies offering far better efficacy combined with a significantly improved tolerability profile for cancer patients, or the successful treatment of viral infections such as Hepatitis C and HIV. Furthermore, we can see a fusion of multiple disruptive future technologies within the global life sciences industry, such as digitalisation, big data, nanotechnology and systemic biology – all exciting elements of an attractive equity story for investors. Combined with an increasing approval rate of new drugs by the FDA in recent years, the global biotech industry market appears to be moving in the right (and profitable) direction. Not surprisingly, the Nasdaq Biotechnology index touched its all-time-high in summer last year and today still trades approx. 50% higher than five years ago. In fact, from a financing perspective, 2018 was one of the most successful years ever for the biotech industry, at least in the US. Nearly 60 biotech companies went public via an IPO in the US last year, representing about 30% of all IPOs in the US in 2018. With this, biotech again topped the IPO activity in the US (followed by technology) as the biotech boom entered its sixth year. US biotech companies raised an amalgamated amount of >USD 6 bn fresh money via an IPO last year. A broader market correction in Q4 2018 proved to be only a short-term issue for investors. Large M&A activities in early 2019 eradicated any investor concerns immediately with Bristol-Myers Squibb offering USD 74 bn for Celgene followed by a USD 8 bn offer from Eli Lilly for the specialised oncology player Loxo Oncology.

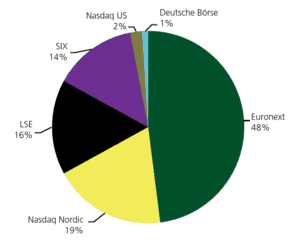

Source: Euronext

Hype in the US versus a more sombre tone in Europe

In contrast to the hype in the US, things in Europe appear more reserved. Only a handful of biotech companies went public in Europe in 2018. An increasing number of German biotech companies rather chose the US Nasdaq stock exchange when looking for fresh money, either via an IPO or a secondary listing (e.g. Morphosys in April 2018 or Biofrontera in February 2018). More recently, Centogene, a German company specialising in the diagnosis of rare afflictions, announced it would soon file its IPO plans with the US Nasdaq stock market. When looking at the European landscape, the multi-national Euronext exchange appears to attract the majority of life sciences IPOs (48% market share since 2013 according to Euronext), followed by Nasdaq Nordic and the LSE. Germany accounts for just one percent market share for all life sciences IPOs in Europe since 2013. This obviously raises questions, as we do not consider the quality of German life sciences companies as being in any way inferior.

„2018 was one of the most successful years ever for the biotech industry, at least in the US.“

Possible reasons for this trend are multifaceted: 1) a limited number of specialised, experienced institutional biotech investors. While seed financing is not so much of an issue anymore, follow-on financing through an expensive drug development programme before as well as after an IPO are often difficult. We view the financing landscape in Germany as rather unchanged over the last 10 years. There are still primarily a handful of dedicated, larger biotech investors including family offices like Athos (Strüngmann brothers) and Dietmar Hopp, but also venture capital investors like MIG and TVM, or private equity investors like Wellington; 2) disappointments from a few negative examples which did not meet the high expectations of European investors in the past; 3) a still generally negative perception regarding gene-technologies among the broader German population, especially with regard to agricultural but also medical products. Reading the German press would lead to a rather bleak impression with regard to the risks and opportunities arising from the biotech industry in Germany; 4) a decreasing number of qualified and experienced biotech analysts in German banks, which can represent a key element in developing an equity story for investors together with the company, followed by a sustainable long-term investor education and regular research coverage after the IPO.

„Germany enjoys a great scientific infrastructure, connecting eminently respectable researchers and scholars with start-up entrepreneurs.“

Several recent positive industry trends in Germany

Despite all these things, we clearly see a number of positive trends among biotech companies in Germany. Germany enjoys a great scientific infrastructure, connecting eminently respectable researchers and scholars with start-up entrepreneurs and an improving, increasingly supportive political environment. Many biotech companies achieved significant clinical milestones recently: Aicuris received US as well as EMA approval for its anti-viral drug Letermovir (Prevymis) in 2017, and the first product developed using Morphosys’s HuCal antibody library launched on the US and European markets in 2017 (Tremfya for psoriasis, marketed by Janssen Pharmaceutical). In addition, some early stage biotech companies were acquired by larger pharmaceutical players (e.g. Rigontec was acquired by Merck &Co in 2017, just three years after its foundation, for EUR 464 m including milestones, and Astellas bought Ganymed for almost EUR 1.3 bn in 2016). The potential IPO candidate Biontech passed the 1000 employee threshold recently, while the more established company Sartorius increased sales by >13% and net earnings by 22% yoy in FY 2018, primarily driven by life sciences products.

„A successful, larger biotech IPO would be clearly desirable to revive the European biotech IPO market.“

Many attractive “hidden champions” as potential IPO candidates

A successful, larger biotech IPO would be clearly desirable to revive the European biotech IPO market. Potential candidates could be the RNA-based therapy players Biontech and Curevac. The development of RNA-based vaccines and therapeutic techniques is a highly promising emerging technology. A similar company in the US called Moderna successfully went public on the US Nasdaq stock market at the end of 2018 (despite temporary adverse market trends at the time), raising more than USD 600 m, valuing the company today at about USD 7bn. Beside Curevac and Biontech, we see various additional “hidden champions” as potential IPO candidates, covering multiple areas like next generation immuno-oncology therapeutics, innovative technology platform companies, but also classical medical technology players addressing a tremendous medical need with their revolutionary products.

Autor/Autorin

Dr Marcus Wieprecht

Dr Marcus Wieprechtis a Managing Director and Biotech/Healthcare analyst atMainFirst Bank AG. He has worked as an equity analyst in the financial industry for more than 20 years. Previously, Dr Wieprecht worked for three years at Jerini AG as a Marketing and Business Development Manager. He obtained his PhD in biochemistry from the Free University of Berlin in 1995.