Following a strong performance in the summer period, shares of German biotech companies were affected by another global downward trend. We have adjusted the basket’s composition in order to increase the liquidity of its composed stocks.

The Biotech & Co. basket, launched in May 2022 by Plattform Life Sciences in Germany and abroad, currently reflects the performance of 24 publicly listed German biotech firms and the Austrian biotechnology company Marinomed, whose shares are traded on German stock exchanges.

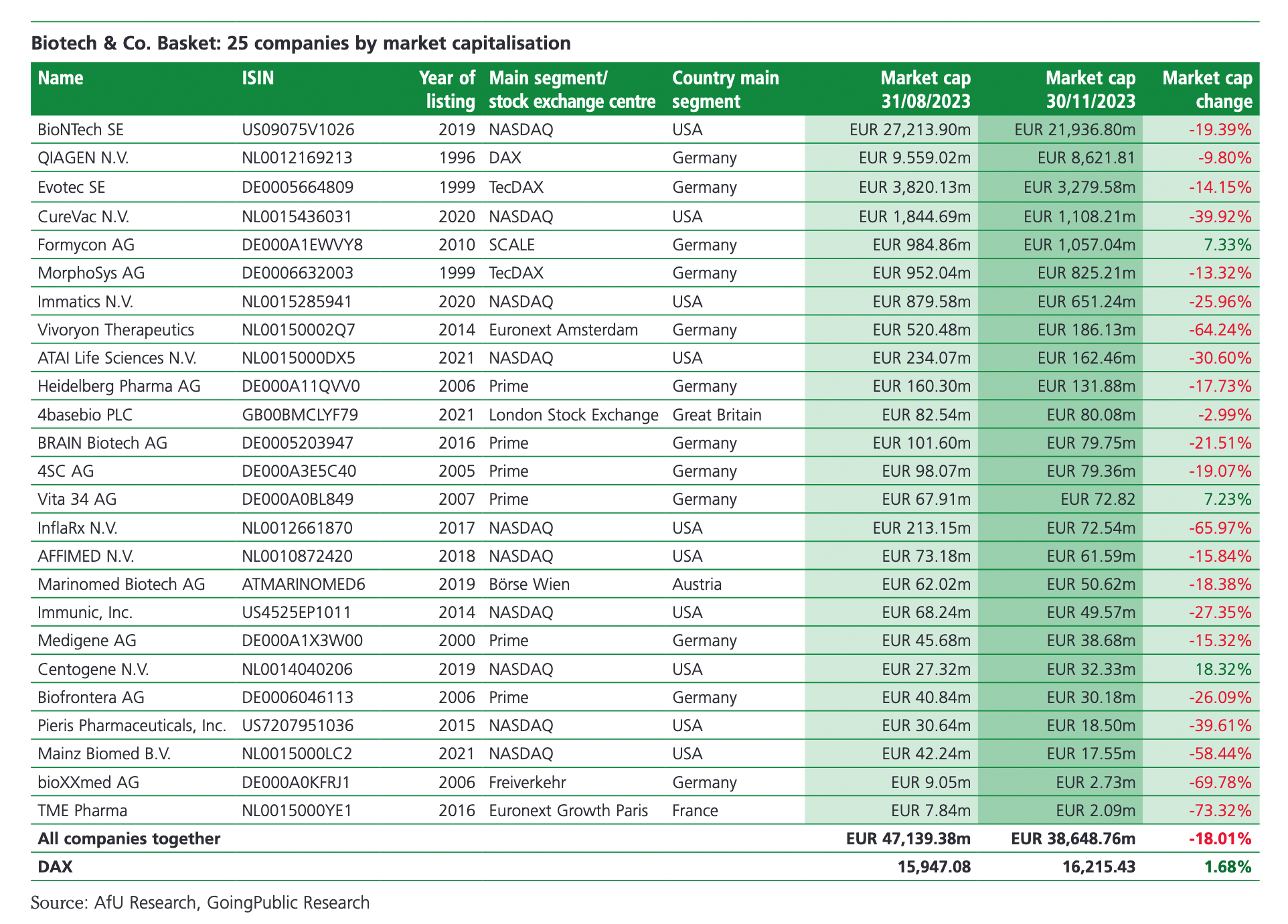

Key figures, trends and share performance of the companies within the biotech basket in the reporting period (1 September to 30 November 2023):

- As of the end of the reporting period, the market capitalisation of all 25 companies amounted to roughly 36.45 billion euros.

- More than half of that amount (56.8%) was attributable to BioNTech AG, listed on the Nasdaq since the end of 2019, and another 22.3% to diagnostics specialist and DAX company Qiagen. Currently, the two largest companies account for almost 80% of the total weight of the basket.

- During the reporting period, the market capitalisation of the companies in the basket decreased by 18%. Significant contributions to this decrease were the losses of 19.4% for BioNTech and almost 14.2% for Evotec, the third largest biotech company by market capitalisation.

- Only three companies (CentoGene, Formycon, Vita34) achieved a positive share performance during the reporting period with Formycon being the only top ten by market capitalisation.

- Five companies (BioNTech, Qiagen, Evotec, CureVac, Formycon) have a market capitalisation of more than one billion euros.

- Out of the 25 companies in the basket, ten have a market capitalisation of more than 100 million euros. A further seven have a market capitalisation between 50 million and 100 million euros.

Negative investor sentiment

The companies included in the Biotech & Co. basket of Plattform Life Sciences were unable to continue their upward trend from the previous reporting period (May to August) during this reporting period. With a minus of 18%, losses were much higher than those of the Nasdaq Biotechnology Index, the most important sector index globally, which lost 5.8% in the same period. In comparison, the DAX showed moderate growth, a moderate increase of 1.7% in the reporting period.

In sum, two main factors contributed to that trend. Small and midcaps are disproportionately affected by the negative market sentiment towards the biotech sector because financial markets continue to discount the company valuation significantly due to ongoing inflation. This is especially the case for those firms dependent on new debt financing in order to continue their operative business beyond 2024. The second factor is that most companies in the basket did not publish significant newsflow which could positively move stock prices in recent months. In contrast, positive news from basket heavy weights boosted the excellent performance during the summer months.

This development underscores our assessment that the market continues to reward success stories with sometimes significant stock gains for individual companies. Conversely, companies that repeatedly fail to live up to expectations are punished with significant share price losses.

Fewer companies, more liquidity

In order to support the attractiveness of the basket for all investors in terms of liquidity, we have decided to take the following step in the face of sometimes significant losses in microcaps: In the future, any company whose market capitalisation falls below 10 million euros will no longer be represented in the basket. For this reason Epigenomics, OpGen, and MagForce are not mentioned in this report, nor is Paion AG, which filed for the opening of insolvency proceedings at the end of October. We will keep an eye on developments to the end of the next reporting period at TME Pharma and bioXXmed AG, which is to hold an extraordinary general meeting on 22 December 2023 to decide about the proposed capital reduction.

To further improve the performance comparison, from 2024 onwards our updates to the Biotech & Co. basket will regularly analyse the performance within reporting quarters. The first report in the new year will be released in early April. Our second significant change will be that the selection will be limited to companies from Germany and Austria listed on German stock exchanges. This is why the Canadian biotech company Defence Therapeutics was no longer considered as part of the basket for this report.

One positive exception

One of the positive performances during the reporting period was the biosimilar developer Formycon, which has submitted the marketing authorization application (MAA) for two biosimilar products. The MAA submission for FYB 202, a biosimilar for the treatment of autoimmune diseases such as psoriasis, Crohn’s disease and ulcerative colitis, was accepted in the USA and Europe. In addition, at the end of November Formycon submitted an MAA for the biosimilar FYB 203 in Europe. This is a generic version of the biological Eylea for the treatment of neovascular macular degeneration and other retinal diseases.

In contrast, MorphoSys and InflarX delivered disappointing news for investors. In the case of MorphoSys, the drug Pelabrisib failed to achieve the expected therapeutic effect in the approval-relevant Phase 3 study for the treatment of myelofibrosis, a disorder of blood formation in the bone marrow. Given the few treatment options to date, the product may still receive approval in the USA in 2024 with restrictions, potentially resulting in lower revenue outcomes than previously expected. InflarX has not yet achieved any significant results with Gohibic in the treatment of severely ill patients due to the weak wave of COVID-19 cases to date.

Summary

With the financial year 2023 nearing to its end, German biotech have been performing particularly bad in that year, which has not been a good one for biotech stocks. Meanwhile, the general sentiment on the financial markets is worse than the fundamental condition of the biotech sector. In the USA, globally still the most important pharmaceutical market, the number of new approvals this year should reach more than 50 and thereby hit the average number of the last five years. Commercial breakthroughs in the treatment of cancer, Alzheimer’s, or obesity will focus investors’ attention on the innovative power of drug developers. German biotechs should also benefit, especially companies like BioNTech or Vivoryon Therapeutics which will be presenting important clinical data next year.

Autor/Autorin

Stefan Riedel

Stefan Riedel ist freier Autor bei GoingPublic Media und selbständiger Redakteur mit Schwerpunkt Finanzen und Wirtschaft.