Bildnachweis: SimpLine – stock.adobe.com, Bryan Garnier & Co., Bryan, Garnier & Co..

The public markets are digesting record biotech IPOs and follow-ons. There is more funding and R&D activity than ever to drive excitement – a notable example being developments in the mRNA space during COVID. But after a record IPO and follow-on biotech issuance volume in the last ten years, deal volume has dropped off to a ten-year low.

It could be a long ride to recovery, and clinical newsflow has not stirred much optimism. Phase II clinical trials have been a key stumbling point, with fewer phase II trial successes reported recently to provide hope that drugs will make it to later development. The increasing cost and risk of development appears to be outpacing drug discovery despite recent improvements in technology (Eroom’s Law), reflected in a front-heavy pipeline and tapering success probabilities.

Strong fundamentals in pole position to be rewarded

Despite low valuations and big pharma‘s dry powder remaining high, an M&A uptick is yet to be seen. Buybacks and renewed focus on in-house R&D may be responsible, though it likely also reflects the reality that though low valuations may provide motivation for M&A, they do not catalyse it. Pharma still only tends to deploy cash for scientifically backed assets and platforms that can replenish topline. A handful of recently announced acquisitions (for example, Amgen/ChemoCentryx, Pfizer/Biohaven and a rumoured Merck/Seagen takeout) have spurred hope of a rebound in M&A, but the limited number and specific nature of these deals still show pharma’s eye is firmly set on safe-haven targets with proof of concept and strong potential.

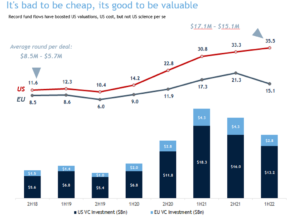

It’s bad to be cheap, it’s good to be valuable

Record fund flows have boosted US valuations and US costs, but not US science per se. While we are seeing an increasing valuation gap between the US and Europe, suggesting a slowdown in the European private space, this is not an indictment of the quality of European companies. With investors tightening purse strings and doing fewer deals, focus will shift to companies with good fundamentals, not just cheaper valuations, providing opportunity for European companies able to show better potential than homegrown US names.

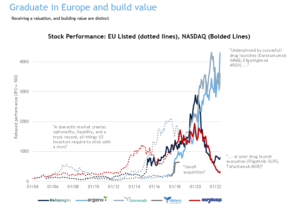

It can be better to graduate to Nasdaq

It is still challenging to plan for the reality of the public market, which especially is true for European companies listing on Nasdaq. For example, BioNTech, known as a key European success story in the sector, only raised USD 150 million in their October 2019 IPO, underwhelming in comparison to some UK direct listings like GWPH.

A better option is to wait. A domestic market creates optionality, liquidity and a track record – all things US investors require to stick with a story. For many European names, it could be better to graduate with strong fundamentals in Europe first, before making the jump to the ‘big fish, big pond’ US market.

It is clearly all about clinical value creation, but receiving a valuation and building value are distinct. Quite often, value is being built but is yet to be seen. Our messages to biotech management aiming at the stock exchange in these difficult times are clear:

IPOs are just one route to funding, and the current market offers plenty of opportunity with funded reverse mergers, flush VCs deploying larger rounds, and pharma reliant on BD for more than half of their assets, implying once inflationary pressure eases, M&A may flourish again. In a more austere market, the focus will be on delivering milestones, and attracting capital and licensing deals to bridge valuations.

Finally: Patience is key. The window is always ajar; we have seen some IPOs take place with good post markets. Newsflow liquidity moments reflect the biggest rebalance of funds has already taken place over the past 18 months. However, we advise corporates to take a longer-term view as valuations will likely come down further.

ABOUT THE AUTHORS

Pierre Kiecolt-Wahl is Partner at Bryan, Garnier & Co and has almost 20 years of experience in international capital markets. Among other things, he helped build the international ECM business for Jefferies from London.

Dylan van Haaften is Managing Director in the Equity Research team at Bryan, Garnier & Co in London. He has been on the sell side for the past eight years at a variety of boutique investment banks and covers biotech and medtech.