Bildnachweis: irissca – stock.adobe.com , Bryan, Garnier & Co., Bryan, Garnier & Co. estimates & company reports.

With 80% of agricultural land already used for livestock farming, there is limited scope for further expansion to meet the expected 78% increase in protein demand by 2050. Therefore, there is an urgent need to use safe, nutritious, and sustainable solutions to feed our growing population. In addition to the traditionally used protein sources with a lower negative impact than meat, some of the newer, biotechnologically produced and cultivated proteins are particularly suitable for potential commercial development, as a new study shows. But what needs to happen for them to be able to exploit this potential in the coming years?

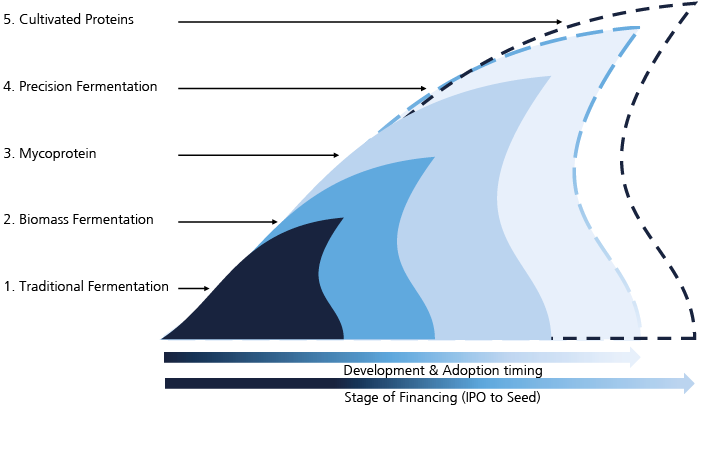

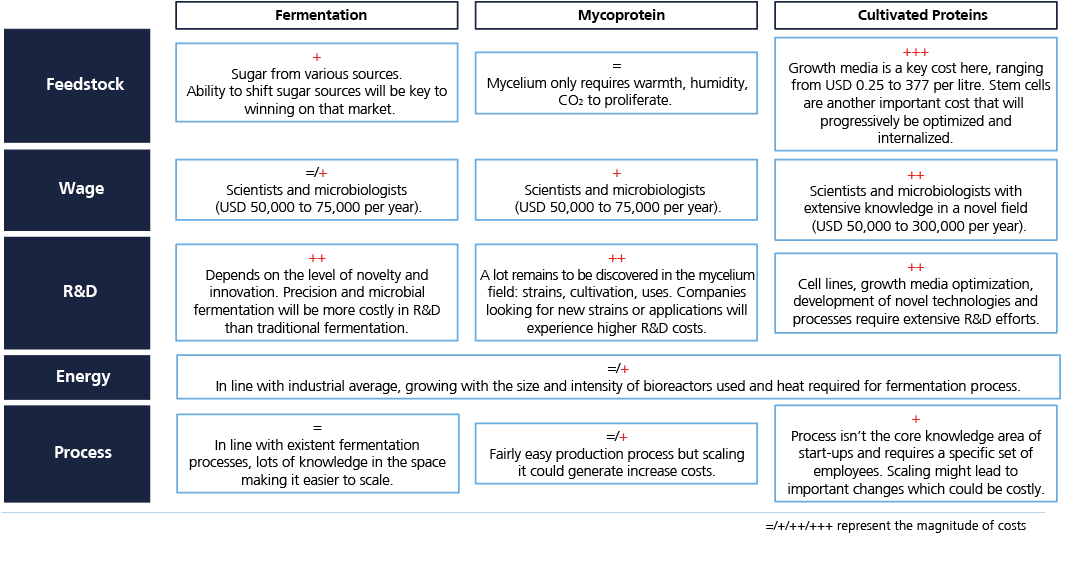

A study conducted by Bryan, Garnier & Co[1] argues that recent strides in technology and science are unveiling the large potential of fermentation beyond the traditional uses seen over the past centuries. Fermentation traditionally consists of using microorganisms to generate desired transformation in foods. It has been used for cheese and beer production for centuries, but recent technological and scientific developments have renewed the methodology. By using enzymatic processes, one can generate ingredients – taking the example of the rare sugar tagatose, Bonumose is able to replicate it that way.

Unlocking the power of precision fermentation

Acting on the microorganisms can enable ingredient producers to enhance their ingredients, or replicate ingredients that would typically not derive from fermentation: that is precision fermentation. Several companies such as Bon Vivant and Standing Ovation from France or American EVERY are using precision fermentation to replicate dairy proteins like lactoferrin and casein. As the alternative proteins space grows, new fermentation technologies can be used to produce ingredients that enhance the taste, texture, and nutritional profile or even make plant-based alternatives taste better by replicating their traditional production process. That is what Väcka is doing with plant-based cheese from fermented melon seeds. Another expansion of fermentation is microbial fermentation, which Solar Foods is using.

Estimates point to a total addressable market for fermentation technologies as big as EUR 104 billion (+9% CAGR growth) by 2030, most of which comes from the alternative proteins applications (EUR 74 billion) and the remaining from the ingredients market (EUR 30 billion).

Mycoproteins on the rise

The use of mycoproteins remains promising. Mycoprotein refers to the use of a biomass fermentation process, i.e. making fungi (mushroom roots) grow to produce a large quantity of product which can then be used as an ingredient – with great nutritional values and texturizing characteristics – or a compact product comparable to tofu or seitan as developed and used by Quorn since 1985 and sold in over 17 countries worldwide. Despite the most common strain, fusarium venenatum, being widely approved by regulation and mycoprotein being quite versatile, high in proteins and fibers, it remains an underrated space in the fermentation landscape as most investors have focused on the most technological areas.

The recent transformation of global mycoprotein leader Quorn into separate divisions for ingredients (Marlow Foods) and direct-to-consumer products (Quorn), as well as close collaboration between the players in Europe, should allow the sector to realise its full potential. Infinite Roots’ USD 58 million fund raise announced at the beginning of 2024 is a good example of the segment’s growing attractivity. This follows ENOUGH‘s EUR 40 million capital raise in August 2023 as well as their close partnership with Cargill to start delivering products soon.

The study estimates the addressable market for mycoproteins to be up to USD 18 billion by 2030, mainly due to the penetration of the meat alternatives market.

Cellular agriculture’s promising future

Cellular agriculture has been the most popular topic in alternative proteins in recent years. Having been used in biotechnology for a while, it is now spreading to the food sector to replicate animal cells in large quantities. The cells can be muscle, fat or even materials. These technologies are still in the early stages, although the major players in the US – GOOD Meat and UPSIDE Foods – have already received regulatory approval.

Despite all development challenges faced by cellular agriculture companies in the coming years, Bryan, Garnier & Co estimates that the addressable market could be worth up to USD 26 billion by 2030.

Key hurdles in the fermentation space

Fermentation technologies have significant opportunities ahead of them and could dramatically change the way we eat. To fulfil this potential, they will need to address several key challenges in the coming years.

The first key challenge comes from regulation. Many countries have been ahead of the curve, such as Singapore, Israel and the US, who have already commercially approved some products, whilst other geographies are moving at a much slower pace. It is in Europe where the studies estimate that, in the best-case scenario, it will take at least two more years before a cultivated meat product can be approved. Nevertheless, political comments in Italy or France are pointing towards difficult negotiations.

“Cultivated meat doesn’t correspond to our conception of the French way of eating”,

said French Prime Minister Gabriel Attal a few weeks ago.

The second large hurdle comes from infrastructure. As fermentation technologies and applications spread, demand for bioreactors capacities is going to surge. Meeting this extra demand will cost up to USD 12 billion, which Bryan, Garnier & Co estimates at 10 billion litres by 2030 (from 45.5 million available today). Questions of manufacturers’ production capacities and financing will need to be addressed to support the growth of fermentation solutions. Governmental support may be one of the solutions, as seen in US President Biden’s executive order for a USD 2 billion investment initiative.

Fundraising activities

Innovation and CAPEX investments will come at a cost that cannot be borne only by the traditional VC investors that have been active in the space so far. Accelerating the regulatory process will be key to supporting investment in the space and enabling companies to go beyond the proof-of-concept stage. The friendlier regulatory landscape in the US has enabled companies based there to raise up to six times more than European companies, which still account for 25% of the companies screened for the paper.

Moreover, involvement from large ingredients companies and food manufacturers will be key to helping accelerate regulation as well as supporting investments. The norm so far has been for large players to invest small amounts in innovative companies and wait until they scale and succeed, becoming large enough to eventually acquire them. More involvement such as capacity sharing, knowledge building, offtake agreements and partnerships will be vital in taking fermentation innovations to the next level. Cargill and ENOUGH are setting a good precedent in the space which we hope to see replicated.

[1] https://www.bryangarnier.com/fermentation-mycoprotein-cellular-agriculture-sustainable-solutions-for-food-production/

Dieser Artikel ist in der Plattform Life-Sciences-Ausgabe 1-2024 erschienen.

Autor/Autorin

Philippine Adam

Philippine Adamis an Equity Analyst covering the Food and Nutrition space atBryan, Garnier & Co, where she has been working since October 2022.