Bildnachweis: Photo: © traceless, Illustration: © petovarga – stock.adobe.com .

In the last years, the number of circular economy start-ups in Germany has increased significantly. There are too many different very heterogenous definitions to compare available data from different sources, but all relevant indicators show an increasing number of new entrepreneurs focusing on circular business models, especially in the field of chemistry (or material sciences).

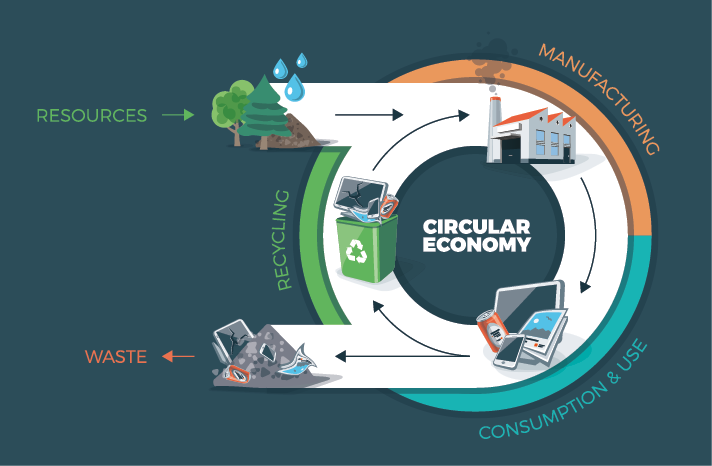

While every individual founder might be driven by personal reasons, experiences, and technical capabilities, how and why to focus on circularity, it is important to understand some general trends supporting these developments. It has become obvious in the last years, that we are facing a huge variety of sustainability challenges: climate change, plastics in the ocean and too many different persisting waste streams to handle them effectively. In the last two years, the scarcity of a variety of economically very relevant natural resources from natural gas to Lithium have been all over the news. Focusing on circular business model helps to tackle all or at least many of these challenges at ones.

Circumventing resource scarcity through circularity

Scarcity of certain raw materials drives up prices and the fear of not being able to ensure a safe and reliable long-term supply increases the openness to look for new options, that might not have been considered in the past. Growing geopolitical tensions have opened the eyes for the increasing risks of global supply chains, the European economy is de-risking their international exposure towards certain countries… Considering all these facts, turning existing waste streams currently still causing costs and complexity into valuable, sustainable and locally available resources, suddenly does not sound like such a crazy idea anymore.

Persisting challenges in circular entrepreneurship

However, the main challenges remain:

- How to ensure a sufficiently stable quality of high-volume waste streams without having to pay for them, or ideally even being paid to take care of them?

- How to technically convert waste into new resources with drop-in qualities, so that these materials can be used together with raw materials from other sources and without any change or upgrade of the existing production facilities.

- How to explain the broad range of different sustainability benefits that will result from the switch to more circular materials and how to use these benefits to the favor of the business?

- How to finance the technical development, the scale-up of the required process infrastructure and the team of experts for all different steps?

Successful founders of a circular economy start-up need the capabilities to solve all these challenges. Overall technology is key: there are usually more than just one method to convert a waste stream into a resource. Having an open mind and not being stuck to just one technical solution seems to be very important. It is all about generating the best fit for the highest overall value, no matter how. While the progress of one technology might be too slow, to build the business with the necessary speed expected by the investors and all other strategic partners, it is important to remember that the progress in different other fields (e.g. analytics, sorting technologies, downstream processing and also of course regulatory change or even regulatory pressure) can have huge effects on a circular business model. Understanding the whole value chain from basic raw materials until the end-consumer, having partners and insides at all different stages and pushing innovation at all levels is a huge challenge but also a huge opportunity to create network effects, that are usually only known from software platform technologies. That is the aspect where the founder’s personality must not be underestimated.

The role of technology in circular innovation

In the last two years, we have seen a growing number of promising young German companies being able to raise significant amounts of public founding to broaden their technological base as a requirement for first external founding from early-stage investors like High-Tech Gründerfonds. Usually this first seed-financing round enables the founders to hire a few experts to complement their team and to build first networks with relevant partners as suppliers for the waste materials as well as with potential customers testing, commenting, and approving their first product samples. In some case there are already tangible results like the first successful pilot to recycle high quality zinc from the ashes of a household waste incineration plant by the company ESy-Labs GmbH from Regensburg. The team of ESy-Labs is using their leading expertise in electro-chemistry, electro-synthesis to solve a variety of recycling challenges. Another example for a holistic circular approach is the development of new processes for textile recycling by the team of EEDEN from Münster. The EEDEN process is enabling the separation and recycling of different garment’s (cotton as well as polyesters) into new raw materials closing the textile loop.

Promising developments in German circular start-ups

A significant break-through in financing the construction of the next scale-up step to increase their production volumes and to enter the market, has been achieved by the team of Traceless Materials from Hamburg offering a bio-circular plastic alternative based on an agriculture waste stream. The founders have managed to raise a significant amount of equity from European investors in combination with non-dilutive grants and debt-financing in their Serie-A round. This financing structure will hopefully become a more common way forward also for other circular economy start-ups in Europe.

Corporate partnerships and scaling

For companies that have already proceeded to their next stage of expansion, scaling their production to even bigger levels, corporate partners seem to be the right partners to grow with even bigger tickets and additional value-add through strategic cooperation or even direct commercial relations. The case of Honda investing in Ineratec GmbH a synthetic fuel / power-to-X / synthetic chemicals company from Karlsruhe can be seen as example showing the significance of strategic corporate investors after reaching a certain stage

of development and Venture Capital financing.

Building confidence: Success stories in circular entrepreneurship

The growing number of successful examples at all different stages is another reason, more founders and more investors dare to believe in the huge opportunity of turning waste into value and to have a significant impact to the economy as well as the environment.

This article was published in the current Plattform Life Sciences issue „Circular Bioeconomy 4_23“, which you can view as an e-magazine via the following link:

https://www.goingpublic.de/wp-content/uploads/epaper/epaper-Life-Sciences-4-2023/#0

Autor/Autorin

Dr Nikolaus Raupp

Dr Nikolaus Raupp, Senior Investment Manager at High-Tech Gründerfonds. Dr. Nikolaus Raupp started his career at a consulting firm and completed his doctorate on the subject of venture capital financing of biotechnology companies in Japan while working. After a year of project management in the biotechnology sector, he moved to the chemical industry at the beginning of 2011. Mr Raupp has many years of international experience as an expert in sustainable innovations, the use of renewable raw materials and climate protection. Since April 2021, he has been an Investment Manager focusing on chemistry start-ups in the Life Science & Chemistry Team of HTGF.