Bildnachweis: ibreakstock – stock.adobe.com, Bryan, Garnier & Co..

Over the past 24 months, we have seen a flurry of transactions in the life sciences tools space: Several high-growth companies providing novel research kits and instruments went public on the NASDAQ stock exchange. By Luc Springinsfeld and Martin Piehlmeier

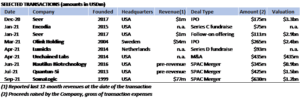

These include Quantum-Sci, Seer, Olink, Nautilus Biotechnology and SomaLogic, which together have raised over USD 2 billion in new money. We have also seen several large M&A transactions, such as the acquisition of Unchained Labs by Carlyle for USD 435 million and large fundraises by privately-owned start-ups such as Encodia or LUMICKS. All these firms provide biopharmaceutical companies and research institutions with new tools and processes to study, characterize and analyze molecules in particular proteins – without any doubt one of the most promising fields.

Proteomics/Multi-omics – the new frontier for 21st century healthcare

Since the 2000s, there has been significant and continued progress in our understanding of genomics (DNA), and transcriptomics (RNA). Many companies such as Illumina or 10X Genomics have helped researchers to decipher the genome with new tools and instruments at ever more affordable price points, thus enabling widespread adoption. Next generation sequencing has accelerated the characterization of individual genomes, which has been central to drug development and healthcare since.

Now, the study of proteins is emerging as the new frontier for understanding real-time genomics in a physiological context. While genomics research in many ways contributed to our understanding of physiology and pathology, the biological (multi-omics) context has been missing in order to fully understand the underlying mechanisms and interactions and develop effective therapeutics.

Proteomics is the next step in the study of biological information systems. It is believed to be one of the most important disciplines for exposing disease-causing protein pathways, uncovering new drug targets, highlighting novel disease subtypes, and identifying clinically-relevant traits. Proteomics is the new frontier of precision and individualized medicine, promising a vast array of innovations to improve treatment outcomes, especially in the areas of immunology, oncology, neurology, cardiovascular, and metabolic diseases.

In oncology, for example, new approaches to treat cancer have rapidly emerged with the use of antibodies or engineered CAR T cells as a substitute of or complement to traditional treatments such as chemotherapy or radiotherapy. These new therapeutic approaches require an increased understanding of individual markers on cancerous cells to offer more personalized and targeted medicine with better outcomes in terms of efficacy and side effects.

Urgent need for better tools will fuel further deals

The problem is that the proteome is generally more dynamic and complex than either the genome or transcriptome.

Although the clinical utility of proteomics is recognized as very high, the accessibility of its content is low and constrained by the limitations of existing life sciences tools. Researchers need better instruments to capture the information and to improve the effectiveness of therapeutics (according to a publication in Nature dated 2015, only 20% of patients respond well to the top ten highest-grossing prescription drugs), and improve R&D productivity: only 13.8% of the compounds used in clinical trials make it to the market.

The existing market for proteomics is already vast, amounting to USD 32 billion spent in reagents (78%), instruments (16%), and services (6%).

Established companies such as Agilent Technologies, Danaher, Bruker or Luminex already provide protein detection and quantification technologies. These are often based on mass spectrometry or standard ELISA (assays), which present significant limitations. The tremendous biological complexity underlying disease presents an enormous challenge because of the limited capabilities of existing tools to characterize interactions at the molecular and cellular level.

With a continuous quest towards high throughput, high-value information, resolution, user-friendliness, and affordability, we at Bryan, Garnier & Co anticipate significant growth and deal activity in the coming years, with increasing amounts of capital being allocated to tools that can improve current diagnostics and drug development processes.

The emergence of new players and a wave of financing and M&A transactions

Researchers are provided with new tools to improve and speed up research with unprecedented accuracy. The study of binding affinities between molecules (such as enzymes and receptors), molecules and cells, or between two cells is one such area emerging players are turning their attention to. Some of these tools can be used in diagnostics, clinical setups, and industrial production.

Last year witnessed a significant amount of capital deployed in companies accelerating biomarker characterization and binding affinity studies as presented in fig. 1.

Since Q3 2021, the public markets have been less buoyant, but we expect more transactions to come once conditions on the public markets improve or momentum further shifts to the private markets.

In Europe, M&A and financing activity has been relatively muted in comparison to the USA, although we have seen some deals, including the acquisition of Switzerland-based Creoptix by Malvern Panalytical (owned by the listed group Spectris) in January 2022.

In Germany and Switzerland, there are a few high-growth companies offering disruptive technologies to accelerate research into proteomics – for example (i) Zurich-based Biognosys, which is backed inter alia by the venture arms of Syngenta and Philip Morris and (ii) two Munich-based companies, NanoTemper Technologies and Dynamic Biosensors. We expect that these companies will receive increasing attention from large life sciences tools incumbents and investors in the future.

ABOUT THE AUTHORS

Luc Springinsfeld is Managing Director at Bryan, Garnier & Co. He has advised several companies in the life sciences tools space over the past two years, including Ginolis and Grundium, a developer of microscope scanners used in digital pathology.

Martin Piehlmeier is Vice President in the German Healthcare team at Bryan, Garnier & Co. and focusses on M&A and ECM transactions in the medtech, biopharma, and digital health sectors.