Due to increasing pressure from stakeholders such as customers, employees, and financial institutions, more and more companies see the need to make their existing business models more sustainable and to integrate sustainability into corporate management. The latest regulations on ESG reporting can be an additional driver to accelerate this change. It is essential that this process of transformation is also communicated transparently and becomes comparable and measurable. This means future ESG reporting under the Corporate Sustainability Reporting Directive (CSRD)and the EU Taxonomy will play a central role.

The relevance of circular economy in CSRD sustainability reporting

The Corporate Sustainability Reporting Directive (CSRD)[1] can be seen as the further development of the Non-Financial Reporting Directive (NFRD). CSRD specifies which companies are obliged to report on sustainability topics and how this reporting should be organised. The content of the reporting is defined in the European Sustainability Reporting Standards (ESRS)[2]. The ESRS are divided into two cross-cutting standards and ten sector-specific standards, which are categorised into environmental-, social- and governance-focused standards. Amongst the environmental standards ESRS E5 defines the disclosures concerning: Resource use and circular economy.

Double materiality as core concept of the ESRS

One of the core elements of the ESRS is the double materiality assessment, which sets out how companies shall derive the material topics which will then be authoritative on what disclosures are deemed necessary under ESRS. The material topics are identified by the undertakings based on two basic criteria: topics that have a financial impact on the value of the company (outside-in materiality) and topics where the company’s business activities have an impact on the environment, society, and various other domains (inside-out materiality). For topics identified material either due to criterion one or criterion two the company must then disclose the related quantitative and qualitative disclosures described in the ESRS to provide a CSRD-compliant reporting.

EU Taxonomy: Classification system for sustainable economic activities

Another instrument in the context of the European Green Deal was set up as EU Taxonomy Regulation, which came into force in July 2020. The purpose of the EU Taxonomy Regulation (2020/852/EU)[3] is to conduct investment flows of the financial sector towards undertakings with sustainable business activities. To enable investors to differentiate sustainable from non-sustainable businesses the regulation provides a standardised scheme to identify green business activities. The EU Taxonomy comprises a list of specific sectors, which constantly is being expanded to meet at least one the following six defined environmental objectives:

1) Climate change mitigation,

2) Climate change adaptation,

3) Sustainable use and protection of water and marine resources,

4) Transition to a circular economy,

5) Pollution prevention and control and

6) Protection and restoration of biodiversity and ecosystems.

In order to identify and report a sustainable and taxonomy-aligned business activity, the business activity must be listed in one of the annexes of the delegated act (taxonomy-eligible) and must fulfil the following conditions: a significant contribution to at least one of the six environmental objectives is achieved; no other environmental objective is harmed (DNSH “Do No Significant Harm”); minimum standards with regard to social criteria and governance (e.g. OECD guidelines) are met.

Circular economy in sustainability

The circular economy is a concept that aims to use resources more efficiently and minimise waste by circulating products, materials, and resources in closed loops. Instead of linear “take-make-dispose” models, where products are disposed of after use, the circular economy emphasises the reuse, repair, remanufacturing, and recycling of products. The aim is to achieve economic benefits, reduce environmental impact and address social issues[4].

ESRS – Resource use and circular economy

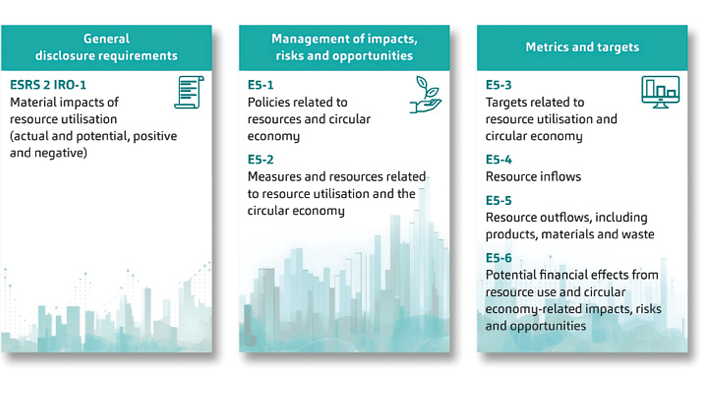

The main objective of the ESRS E5 standard focuses on a more responsible resource utilisation and the circular economy, and the shifting of the “business-as-usual” approach from currently predominantly linear economic concepts to a more circular concept. The overarching aim of the standard is to define disclosure requirements for material impacts, risks and opportunities arising from resource use and the circular economy, as well as for the associated strategies, measures, and financial implications. The E5 standard serves as a reporting standard for companies that have identified resource use or circularity as a material topic in their materiality assessment. It requires undertakings to disclose their strategies for managing their material impacts, risks from resource use and transformation from a linear to a more circular use and opportunities, i.e. all actions they have taken to address resource use and circularity (see Fig. 1). These descriptive disclosures are complemented by mandatory data points and targets, i.e. the weight and percentage of non-virgin reused or recycled components, intermediary products and materials used to manufacture the undertaking’s products and services (ESRS E5-4, 31c).

EU Taxonomy – Substantial contribution to the transition to a circular economy

In June 2023, the EU Commission adopted the further delegated regulation on the EU environmental taxonomy with separate annexes governing the technical screening criteria for four environmental objectives: pollution, biodiversity, marine resources, and the transition to a circular economy[5], in addition to the yet to be reported environmental objectives of climate change mitigation and adaptation from 2022. For reporting periods starting on 1 January 2023, it became mandatory for undertakings within the scope of sustainability reporting to report on the taxonomy eligibility of these four additional objectives. Across all other objectives of the taxonomy, the circular economy can reduce/avoid the environmental impacts of activities along the entire life cycle. In the case of plastics, for example, a more circular economy means a reduction in the extraction of oil and other raw materials through to the production of packaging and disposal. These reduced environmental impacts relate to climate change, pollution, water use and biodiversity. This highlights the transition to a circular economy as an important objective.

The EU Commission has previously provided guidance on where the focus needs to be in accelerating the transition to a circular economy, notably in the EU Circular Economy Action Plan published in 2020[6]. In total, the annex describes 19 economic sectors, categorised into manufacturing (plastics, packaging, textiles, electronics), construction and civil engineering, restoration and remediation, sewerage, and waste management. The construction and real estate sector are particularly affected as, e.g., non-hazardous construction and demolition waste must be reused or recycled. For some materials, there is also a limit on the use of “new” construction materials – the difference must be compensated by reused/recycled materials.

Reporting on the circular economy: a variety of opportunities

Reporting on strategies and activities aiming for a more circular economy increases transparency, better enables comparison of investment opportunities, and gives companies the chance to stand out from the “crowd”. Undertakings that future-proof their business through circularity can demonstrate these efforts in their reports and gain a competitive advantage. Companies that recognise these advantages can reduce costs, accelerate decarbonisation, and build resilience through circular business models. In addition, a robust circular business model may help companies to better respond on stakeholder demands and boost investors’ confidence at times when the financial sector is increasingly weighing in sustainability performance and ESG risk mitigation for investment decisions.

Early engagement with circular economy can help organisations be forerunners and leaders within their economic habitat. It also helps them stay ahead of the transition and keep up with the evolving regulatory, reporting and compliance requirements.

[2] https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13765-European-sustainability-reporting-standards-first-set_en

[3] https://eur-lex.europa.eu/eli/reg/2020/852/oj

[4] Ellen MacArthur Foundation. „Towards the Circular Economy: Economic and Business Rationale for an Accelerated Transition.“ 2013.

[5] https://finance.ec.europa.eu/system/files/2023-06/taxonomy-regulation-delegated-act-2022-environmental-annex-2_en_0.pdf

[6] https://eur-lex.europa.eu/legal-content/EN/TXT/?qid=1583933814386&uri=COM:2020:98:FIN

This article was published in the current Plattform Life Sciences issue „Circular Bioeconomy 4_23“, which you can view as an e-magazine via the following link:

https://www.goingpublic.de/wp-content/uploads/epaper/epaper-Life-Sciences-4-2023/#0