Overview and timeline

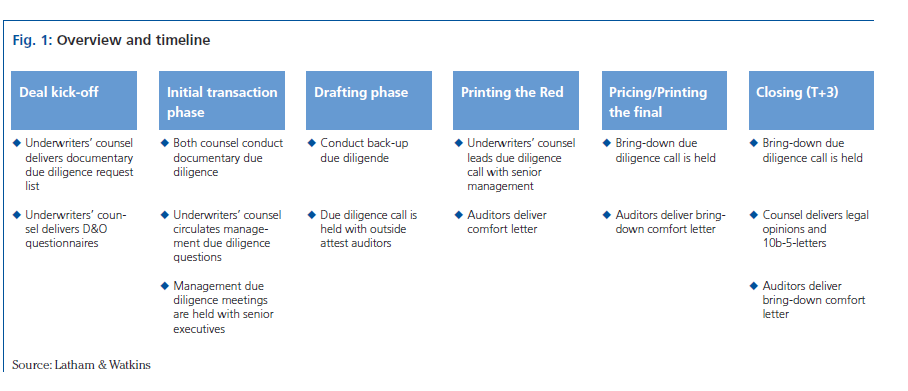

The various stages of due diligence in a U.S.-registered securities offering may look like the example in figure 1.

Documentary due diligence

Documentary due diligence consists primarily of reviewing documents (corporate documents, contracts, correspondence etc.) assembled in an online data room by the issuer. These documents cover the last three years and the interim period through the closing of the offering. The underwriters, as well as other offering participants, expect these documents to be assembled in accordance with a due diligence request letter, which aims to comprehensively list all relevant documents, with a view toward addressing disclosure and risk assessment questions related to the issuer. While German issuers may at first be overwhelmed by such a request, it significantly helps structuring and tailoring the due diligence process by distinguishing material information. For example, underwriters’ counsel typically analyzes which of the issuers’ subsidiaries are material (and thus for which information must be provided) and defines materiality thresholds for contracts and certain assets. The request also serves as a reminder of which questions must be asked. Ultimately, the number of documents to be produced is much less dramatic than initially feared.

The purpose of documentary due diligence is first to establish that the issuer’s organizational and other documents are in proper order and that the offering will not violate any laws, regulations or material contracts. Second, it serves to gather information for the drafting of the offering documents. For example, it must be ascertained that the issuer’s corporate governance documents and management composition comply with the rules of the relevant U.S. exchange (as there are several differences between German and U.S. -exchange requirements). Particular emphasis is placed on reviewing board minutes, notes to financial statements, outstanding debt and securities granted, material contracts, auditor correspondence and third-party issues. If a red flag (anything that raises questions or calls for further explanation) is discovered, additional investigations will follow until a satisfactory explanation has been provided or adequate disclosure has been incorporated into the offering documents.

If certain areas, such as regulatory compliance, intellectual property or taxes, are important to an issuer, legal specialists may need to be involved. Because U.S. laws on foreign trade, trade sanctions, corrupt practices and anti-bribery tend to be stricter than their European equivalents and often have a global reach extending to acts outside the United States, this may be an area of particular focus during due diligence. Due diligence can also become more complex when the issuer’s compliance with the requirements of the U.S. Foreign Corrupt Practices Act is concerned. Equally sensitive are questions of compliance with the rules of the U.S. Office of Foreign Asset Control (OFAC), which administers and enforces economic sanctions programs against specifically designated countries, individuals and entities. While OFAC’s rules apply only to U.S. persons, this term has been broadly interpreted and may include a foreign issuer with business dealings in the United States. OFAC’s rules also prohibit underwriters from assisting on transactions with an issuer who violates such rules, and underwriters may be sanctioned for a violation even if they were unaware of its existence, which is why there can be a particular emphasis on OFAC compliance during due diligence.